Scalp trading has emerged as one of the most popular trading strategies in the Forex market, offering traders the opportunity to make quick profits and maximize their capital. By executing a large number of trades with short holding periods, scalp trading aims to capitalize on small price movements. In this article, we will delve into the intricacies of scalp trading in forex, exploring its strategies, benefits, and the tools you need to get started. For additional resources, you can check out scalp trading forex Philippine Trading Platforms that cater to scalpers.

What is Scalp Trading?

Scalp trading, often referred to simply as “scalping,” is a trading strategy that involves making numerous trades over very short time frames—sometimes within seconds or minutes. Traders who engage in this strategy, known as scalpers, aim to profit from small price fluctuations in currency pairs. Unlike long-term traders who hold positions over days or weeks, scalpers prefer to close their positions quickly, thus minimizing exposure to market volatility.

Benefits of Scalp Trading

Scalp trading offers several advantages that make it appealing to many Forex traders:

- Quick Profits: Scalpers can realize gains in a matter of minutes, which can lead to rapid account growth.

- Less Market Exposure: With trades held for a very short time, there is less risk of adverse price movements impacting a trader’s position.

- High Frequency of Trades: Scalpers often execute dozens or even hundreds of trades in a single day, allowing for numerous profit opportunities.

- Disciplined Trading Environment: The fast-paced nature of scalp trading can instill a disciplined approach to trading as scalpers must adhere to their strategies strictly.

Key Strategies for Successful Scalping

Effective scalp trading requires a well-defined strategy. Here are some popular scalp trading strategies that traders can implement:

1. Trend Following

One of the most straightforward strategies is to follow the prevailing trend. Scalpers identify the direction of the market trend and execute trades that align with that trend. This approach maximizes the chances of executing favorable trades.

2. Breakout Trading

This strategy involves identifying significant price levels (support and resistance) and entering trades when the price breaks out of these levels. Breakouts often signal strong price movements that scalpers can capitalize on for quick gains.

3. Range Trading

Range trading focuses on identifying a price range where a currency pair has been trading. Scalpers can buy near the support level and sell near the resistance level, making profits from the fluctuations within that range.

Tools and Indicators for Scalp Trading

To be successful at scalp trading, traders need to equip themselves with the right tools and indicators:

1. Trading Platforms

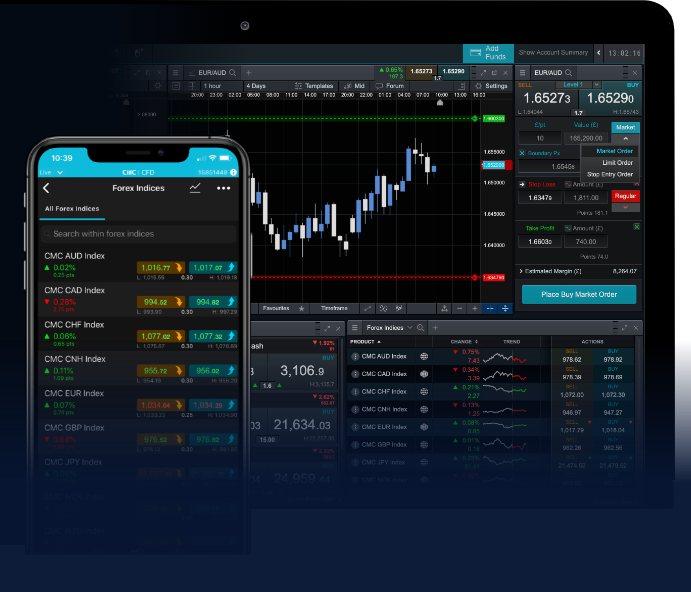

Choosing the right trading platform is crucial. Look for platforms that offer low spreads, fast execution times, and advanced charting tools. Some traders might prefer platforms with built-in scalping features.

2. Charts and Technical Analysis

Scalpers should rely on real-time charts and technical indicators. Popular indicators for scalping include Moving Averages, Bollinger Bands, and Relative Strength Index (RSI).

3. Economic Calendars

Keeping an eye on economic news releases is vital. High-impact news can lead to increased volatility, which may present trading opportunities for scalpers but can also increase risk.

Risk Management in Scalping

Effective risk management measures are essential for any trading strategy, especially scalp trading due to its fast-paced nature. Here are some tips for managing risk:

- Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses. This way, you can protect your capital even in fast-moving markets.

- Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and account size.

- Avoid Overleveraging: While leverage can amplify profits, it can also lead to significant losses. Be cautious with leverages when scalping.

Conclusion

Scalp trading in the Forex market can be a rewarding endeavor for those willing to dedicate time and effort to mastering it. By understanding the techniques, tools, and risk management practices, traders can enhance their chances of success. Remember, practice is key—consider creating a demo account to hone your skills before trading real money. With the right approach, scalping can be a lucrative way to engage in Forex trading.